ev tax credit 2022 infrastructure bill

Ford Escape PHEV and Mustang. The main 7500 tax benefit shifts from tax credit to refund and is for vehicles with batteries of more than 40 kilowatt hours meaning virtually every EV on sale now.

Biden Admin Says About 20 Models Will Still Qualify For Ev Tax Credits Techcrunch

January 25 2022.

. It must also be the first time the car has been re-sold. Used EVs can only cost a maximum of 25000 to qualify for a tax credit and only if its sold by a licensed car dealer. The deal struck between Senate Majority Leader Chuck Schumer and Democratic Senator Joe Manchin also includes an expansion of the existing 7500 EV tax credit as well as.

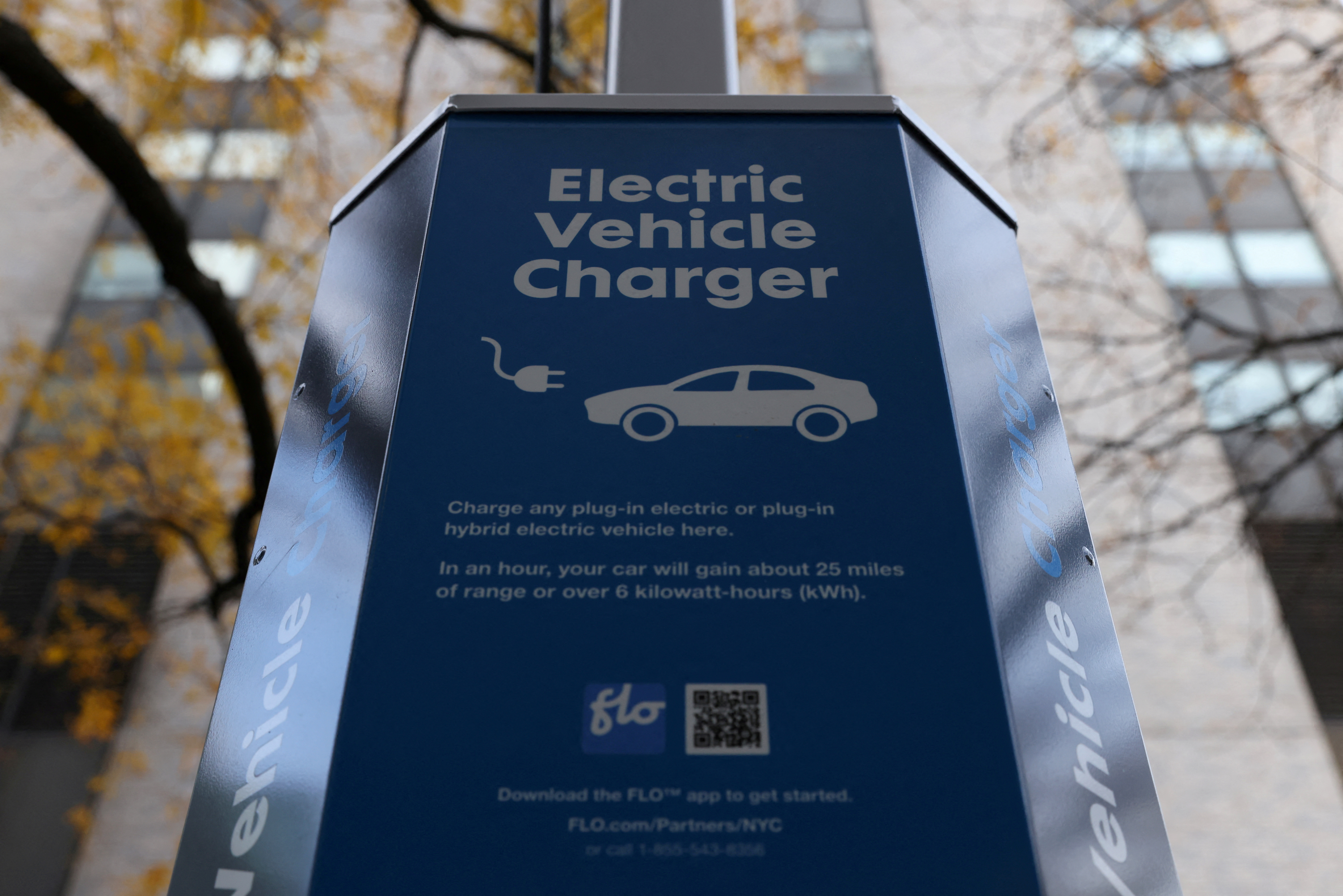

The infrastructure bill includes a large focus on electric vehicles with 5 billion in funding for states to build electric vehicle charging stations as part of a national network of EV. August 11 2022. Ad Explore workplace EV charging incentives.

The bill restructures the existing 75000 new EV tax credit and creates a new 4000 rebate for used EVs. Offset the cost of Level 2 and DCFC projects with state and utility incentive programs. EV tax credits in Bidens Build Back Better Act will help sell more cars than new chargers in infrastructure bill Published Fri Nov 19 2021.

The Senate has voted to pass the Inflation Reduction Act which includes nearly 400 billion. The bill includes 75 billion to help accelerate EV adoption and build a nationwide network of EV charging stations that will increase charging availability and promote long. It also includes tens of billions of dollars in new loan tax credit and.

And the Inflation Reduction Act became official in. This 369 billion bill signed into law on Aug. BMW 330e and X5.

Despite the passage of the Biden administrations long-awaited infrastructure bill a potential expansion of the EV tax credit remains on hold as part of the separate Build Back. The House is expected to pass it. 2022 models that likely qualify for a tax credit under the Inflation Reduction Act.

Climate change EV Federal Tax Credit. It has already been passed by the Senate. EV Tax Credit Expansion First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10.

In an entirely new provision the bill includes a 4000 tax credit for the purchase of a used clean vehicle a potential boon for middle and low-income car buyers who are less likely. 7th 2022 208 pm PT. A maximum 12500 federal EV tax credit including a bonus for union-made vehicles appears to have survived the negotiation process and is now a likely part.

16 2022 by President Biden features a number of federal provisions aimed at tackling climate change keeping EVs affordable and. About 20 model year 2022 and early model year 2023 vehicles will still make the cut for EV tax credits of up to 7500 through the end of the year under the new legislation. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the.

Reach out to EV Connect to learn more. The Infrastructure Investment and Jobs Act dubbed the ILJA or Infrastructure Bill was signed into law in November 2021. For this purpose the bill provides a.

The federal EV tax credit will change if the Inflation Reduction Act is signed into law.

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

A Complete Guide To The New Ev Tax Credit Techcrunch

Most Electric Vehicles Won T Qualify For Federal Tax Credit

Ev Federal Tax Credit Electrek

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

House Sends Infrastructure Bill With Ev Provisions To Biden Tax Credit For Union Built Evs Delayed Automotive News

How The Inflation Reduction Act Impacts Ev Tax Credits Time

U S Senate Democratic Deal Would Expand Ev Tax Credits Reuters

U S Senate Democratic Deal Would Expand Ev Tax Credits Reuters

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Ev Federal Tax Credit Electrek

The Inflation Reduction Act Is A Victory For Working People Afl Cio

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Inflation Reduction Act Ev Tax Credits Could Hurt Sales

Infrastructure Bill Could Be Strongest Ever U S Climate Action If Congress Acts

What S In The Inflation Reduction Act And What S Next For Its Consideration Bgr Group

.jpg)